9 Unique Investments Other than Stocks

Stocks aren’t the only path to getting the financial freedom you desire.

When people think of investing, the idea of stocks, bonds, real estate and now even cryptocurrency crosses their minds. But just because they’re the most known, that doesn’t mean they’re the only options or the most profitable.

It’s time to rethink your investment strategy. There are so many other ways to invest your money.

From fine wine to luxury watches and vintage cars, there are new ways to invest that aren’t stocks. In fact, investing in art or timepieces often provides far better returns compared to the stock market.

If you’re intrigued to explore greener pastures, grab a magnifying glass and take a closer look at these unheard-of investment strategies. After all, conventional wisdom is boring. Why not have fun, while investing?

Here are some ways to invest that aren’t stocks, and will make you excited to spend your money. Don’t forget that when you invest, you’re buying a day you don’t have to work. Let’s explore 9 unique investments other than stocks:

Alternative investments

Please note: While we love sharing our passion and knowledge, and we wholeheartedly believe you’ll travel happier through this journey called life when you’re building wealth and have financial freedom, we highly recommend seeking professional advice before investing in any large purchase.

Fine Wine:

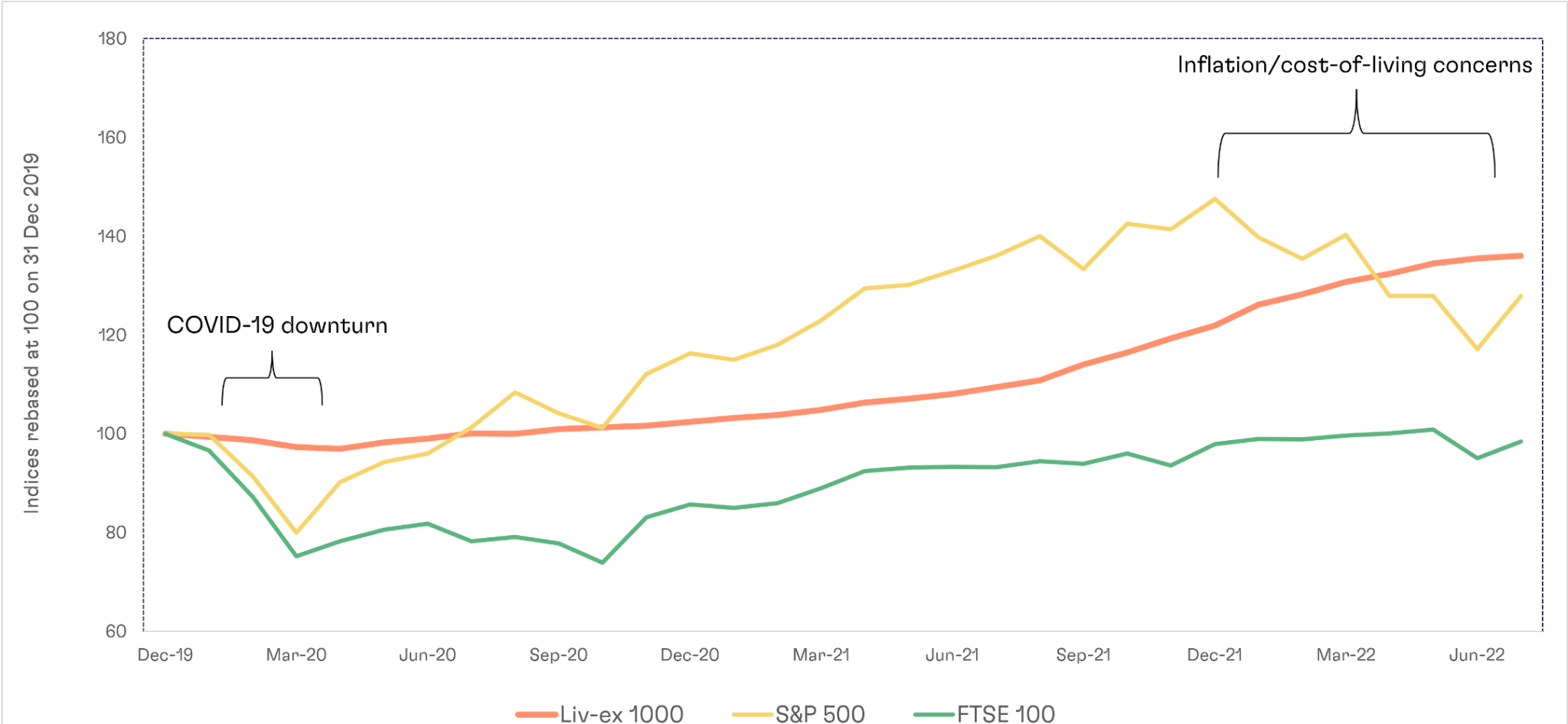

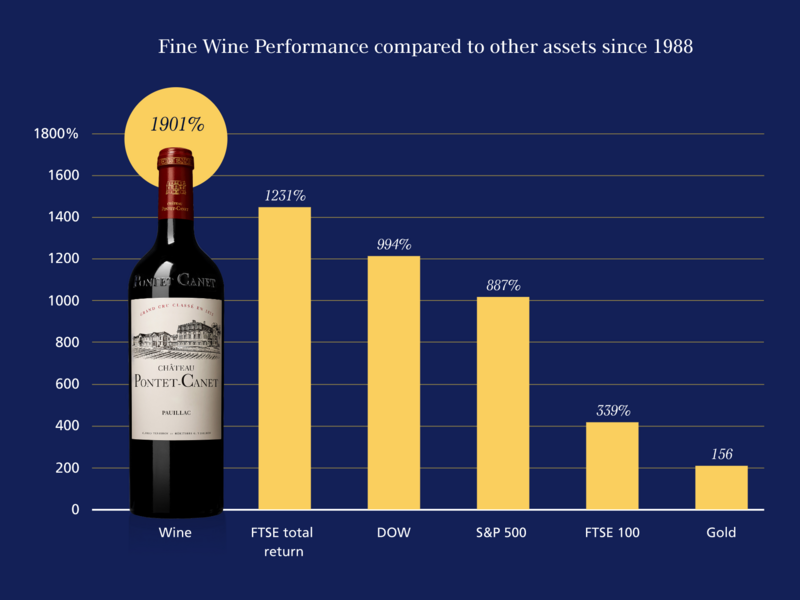

Fine wine not only tastes better with age, but its value also increases with time. Unlike stocks and bonds, fine wine delivers returns that have no correlation to the stock market. Its low correlation to the stock market makes it recession-proof. When investing, it’s ideal to have a mixture of both, to lower your risk. I’m sure you’ve heard many investors stress the importance of diversification. Well, fine wine offers a unique opportunity to diversify.

The world of wine is so fascinating and can be a very lucrative investment. You can make so much money investing in the wine market. Since 2005, Sotheby’s Wine Index has repeatedly outperformed the S&P 500. It’s honestly the best-kept secret in investing.

Fine Wine outperformed the S&P during COVID-19 and inflation

Source: Investing.com, Liv-ex 1000 as of July 31, 2022.

Source: Vin-x

Here’s another secret, fine wine is not just an after-hour treat but an asset worth preserving. Keep in mind that just like how you would invest in a variety of stocks and not just one, you’ll want to invest in a variety of wines to avoid placing too much weight on the performance of one type. When deciding which wine to invest in, remember that quality and rarity are key. It’s important that you choose invest-grade wine.

You’ll also want to evaluate the wine’s price history and look for trends that show upward progression. If you’re passionate about wine, this could be a fun way to invest and make some money. Just be sure not to drink it all.

If you’re interested in wine investing, check out this beginner’s guide.

If it sounds a bit intimidating, there are wine investment platforms like Vinovest that allows the average Joe to invest in wine, just like the wealthy. Vinovest is great if you don’t have the expertise and knowledge to determine which wines will perform well or the mansion to even store them. Vinovest will buy and store the wine for you so you can relax and track your portfolio. Their team of world-class sommeliers will help build your portfolio, with wines picked for maximized returns.

You’ll need at least $1000 to invest. And no worries about the insurance. They’ll take care of that for you. With Vinovest you can relax without the stress. While relaxing, if you’re feeling kinda thirsty or in need of a glass of wine, they can send bottles to your doorstep, so you can have your profits and drink it, too. How cool is that? A total liquid asset!

Yep, that’s right, investing in wine is truly a liquid asset. After all, you can’t eat stock (unless it’s corn), but you can sip a glass of wine. Before you decide to invest in wine, there are a few things to consider.

Is wine investing right for you?

- If you already have a basic portfolio of stocks and bonds and want to diversify then it’s for you.

- If you’re curious about wine or alternative investments, it’s definitely for you.

- If you’re new to investments, you should take a pause and try one of the other alternative investments below. Keep reading.

Pros of Wine Investment:

- Wine holds its value in a volatile market. In 2020, when the world seemed to fall down like a tower of Jenga blocks, wine saw a healthy double-digit increase.

- They’re tangible and enjoyable assets.

- Low maintenance investment.

- Stable investment strategy, the prices tend to be consistent over time.

- Reasonable returns.

Cons of Wine Investment:

- Shipping and storage costs.

- Insurance and initial investment.

- It’s like marriage, a long-term commitment.

- Can take up to a decade to reach value.

- You may be tempted to drink an entire case in one day. Hey, we’re not judging.

If this sounds complicated. We get it! Investing in wine is not for everyone. Just grab a drink and read on for some other great alternative investments.

Luxury Watches:

Forget the fugitive, luxury watches are at the top of the Most Wanted List and I’m not talking about America’s. Luxury watches are not just a status symbol or fashion pieces to complement your outfit. They can complement your investment portfolio, too. Luxury watches have evolved into one of the most rewarding alternative investment options.

Like wine, luxury watches have been around for centuries and are only increasing in value. Rolex, for example, has doubled in value every ten years since the 1970s. Other brands like Patek Philippe, Omega, and Cartier have also seen similar returns.

Pre-owned luxury watches have become a popular investment in recent years. While the stock market has seen its fair share of ups and downs, the luxury watch market has steadily increased in value.

Luxury watches are less volatile than the stock market. In addition, many experts believe that the luxury watch market is recession-proof. Bonus points because it’s way cheaper than real estate.

Luxury watches hold their value well and can be passed down for generations. It’s the gift that keeps on giving. Plus, luxury watches are a lot more fun to look at than a stock certificate!

What makes luxury watches a good investment?

For starters, there is a limited supply of some of the world’s most popular brands, such as Rolex and Patek Philippe. Due to supply shortages and a 6-year-long waitlist, luxury watches often resell for a premium. They can sell for 2-3 times their retail prices. (For instance, a Rolex Daytona purchased last year for $12,689.38 is now selling for $24k, or insert Mark’s example)

But don’t you dare go on a watch shopping spree, just yet. You have to choose carefully. Not all watches are created equal. There are certain watch models that most likely will increase in value. Here are a few:

- Rolex

- Audemar Piquet

- Vacheron Constantin

- Omega

- Patek Philippe

A report from McKinsey estimates the total value of the pre-owned luxury watch market to be currently worth $20 billion, and it’s set to be the industry’s fastest-growing retail segment, topping $29 billion by 2023. Luxury watches are hotter than they have ever been. Rolex doesn’t make enough watches to meet demand and this scarcity has led many flocking to the secondary market.

If you want to get started in the world of luxury watch investing, do your research on supply and demand. Familiarize yourself with different brands and models so you’ll know the watch you’re buying is authentic and in good condition. You can find plenty of helpful information online.

How to Invest in Luxury Watches

There are many different ways to invest in watches. You can purchase a watch outright and hold it until it increases in value or you can trade watches. Watch trading is becoming more popular as it’s a quick way to make money in the luxury watch market. According to CNBC, ‘Demand for high-end watches exploded during the Covid-19 pandemic, which resulted in an online boom in the business of buying, selling, and flipping pre-owned and vintage watches.’

With the online boom, many watch-selling platforms were launched, where you can buy and sell watches. The only problem is a lot of these sites can’t guarantee the authenticity or that the watch is even working. Just make sure you do your research before making your purchase, as the luxury watch market is full of fakes and overpriced watches.

We’d suggest staying away from the malls, as they tend to be overpriced. You can purchase pre-owned luxury watches on reputable sites like eBay, which offers an authenticity program and secure delivery at no extra cost to you. Feel free to browse Mark’s timepiece collection. Just choose the right watch at the right price. Try to get it at MSRP. It’ll likely hold value over time.

The best thing is you get to wear it too. Who doesn’t love a good accessory?

Pros of Luxury Watch Investment:

- It’s a great way to make more money, without more problems

- The price has never depreciated since the 70s. Like EVER!

- You can enjoy wearing it every day and still sell it for a profit

- It’s more secure than stocks and crypto.

- Luxury watches hold their value during market downturns. Hello, 2022 financial crisis!

- Excellent source of passive income

- The value of luxury watches has increased an average of 10%-15% each year for the last 20 years

- Demand is expected to continue to surpass supply. The Big Four watch brands will continue to maintain low production, to preserve their exclusivity. This means prices in the secondary market will continue to rise.

- You can quickly convert it to cash if you need to

Cons of Luxury Watch Investment:

- Emotional ties to watch. Take your heart out of the game and invest with your brain.

- Expertise: there’s knowledge, and strategy required

- You need to know what you’re buying. There are a lot of ‘plastic’ or fake watches

- You’ll need to have at least $5k for a substantial return

Mark’s all-time favorite way to not just invest but to get a passive income is timepiece investing. It’s fun, simple, and produces exceptional returns if executed effectively. While watch trading will get you high returns, timepiece investing is a completely different animal. You’ll receive far better returns (20%-50% on average), as the market appreciates over time. Watch trading is perfect if your bank account needs a lifeline boost, while timepiece investing is for building long-term wealth.

Curious but still not totally sure? It’s okay to start small. The market sells fast so you can easily turn it back into cash. If you’re like 50 Cent and have 21 questions, you can reach out to Mark, he’ll steer you in the right direction.

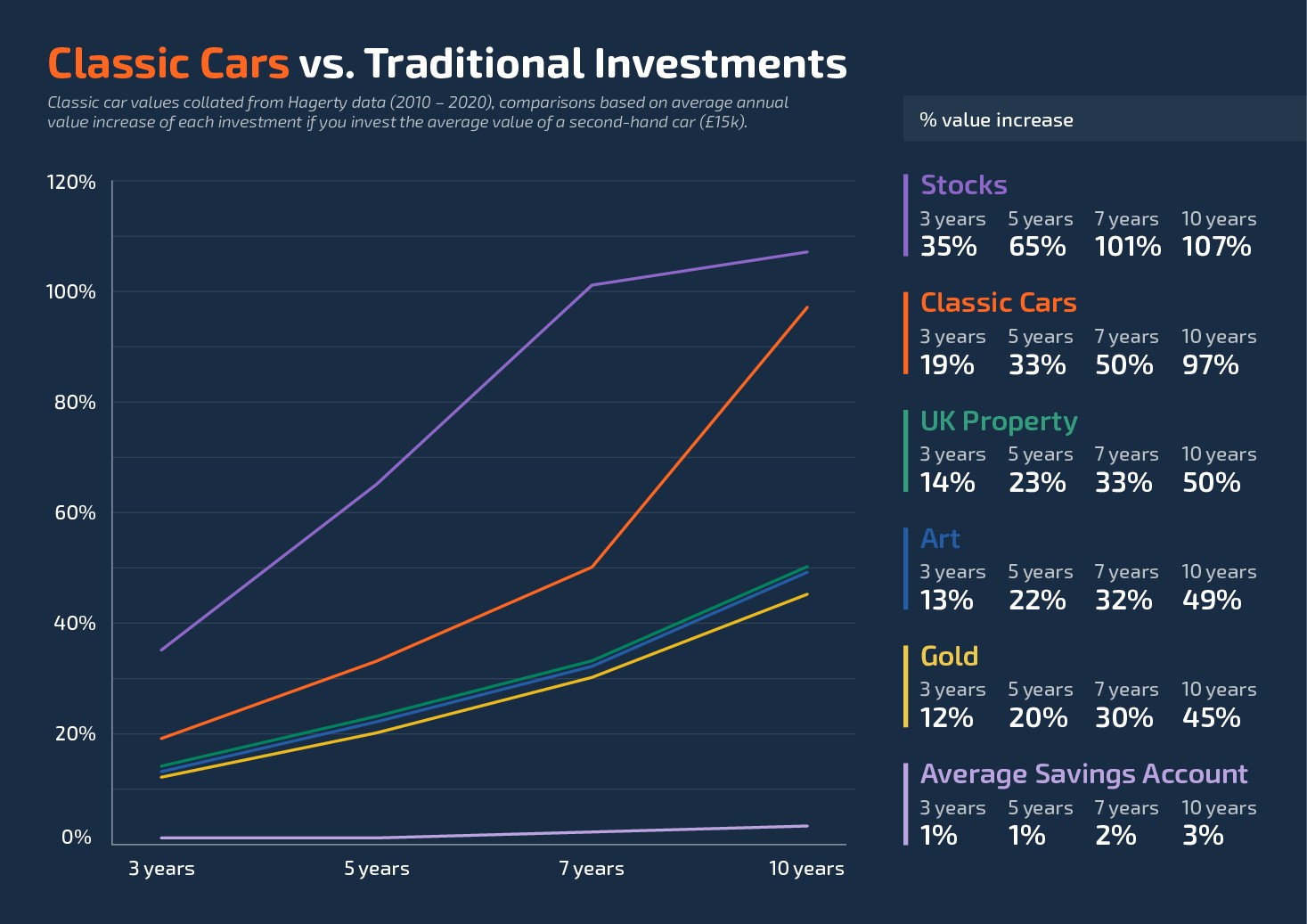

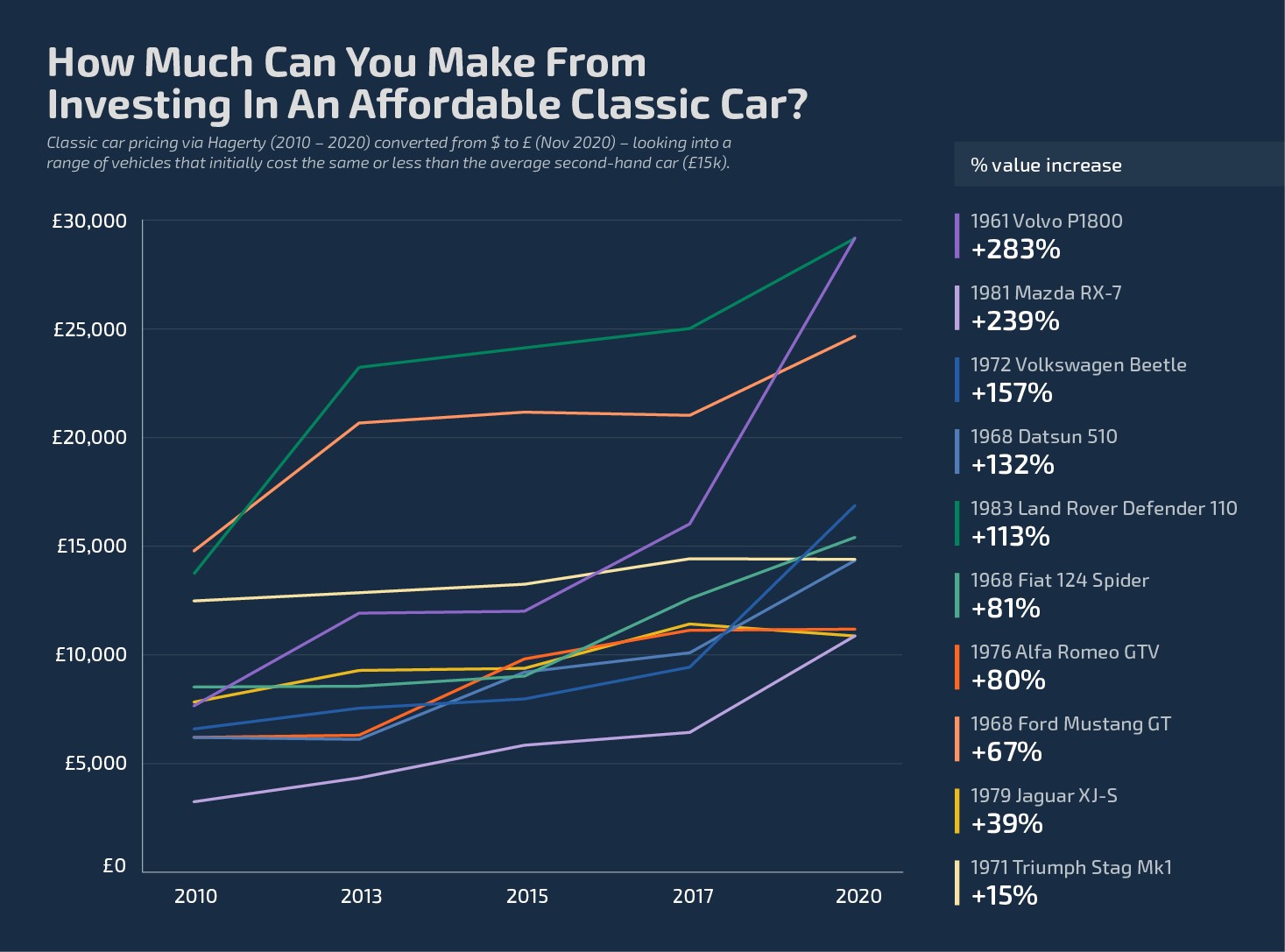

Classic Cars:

Speaking of steering, have you ever thought about investing in cars? It’s a lot like watches, but with four wheels and an engine. I’m just joking. But I’m sure you’ve heard a million times that a car immediately depreciates or loses value the second you drive it off the lot. So why would anyone in their right mind invest in a car? But that’s not always the case. Turns out, a luxury car is a real asset and another way to invest outside of the stock market.

Source: Vanarama

As crazy as it sounds, there are some cars that hold value and will get any driver on the road to alternative investing. It’s a fascinating world we live in, where not just coffee aficionados and avocado toast eaters enjoy their last drop of Joe or scrumptious bite, but where classic car collectors can enjoy every mile in their ride to the fullest.

If you’re looking to turn your love for the fast and the furious and oh-so-luxurious cars and wheels into real returns, here’s what you should know if you’re thinking about test-driving car investing for yourself.

Investing in cars is not as simple as buying a car and hoping it goes up in value. Of course, you can’t just go out and buy any old car and expect it to appreciate in value. Just make sure it’s a classic car and not some new hotrod off the factory line.

You need to do your research and invest in a car that has the potential to go up in value. If you know what you’re doing, you can make a killing. Classic cars have been known to increase in value at a rate higher than inflation. One example is the Ferrari 250 GTO, which has seen its value increase by 20% each year since 2000. If you’re looking for a profit-driven investment machine, investing in cars is your driving force. According to U.S. News and World Report, classic cars had a 500% increase in value between 2004-2014.

Source: Vanarama

The key is to find a car that’s going to appreciate in value. And there are a few ways to do that. It’s best to buy at the bottom of their depreciation curve, they tend to bounce back up in price and hold value well. It’s important to do your research and purchase the right car. You also need to factor in storage and maintenance costs. The greatest joy is in driving, the investment return is the added perk.

Pros of Investing in Classic Cars:

- You’re essentially getting paid to drive exotic cars. It’s a physical asset that you can enjoy driving.

- Lack of supply has caused second-hand cars to increase in value

- It’s a great strategy to diversify your investment portfolio.

Cons of Investing in Classic Cars:

- May require significant maintenance to retain value.

- Classic cars can be difficult to insure and maintain, so be sure to do your homework before making a purchase. Depends on supply and demand. The market can be volatile.

- High capital is needed to invest. Unless you have $50k burning a hole in your pocket.

- Requires some serious know-how. You need to know what you’re buying

- Not the best choice for short-term investors

Wouldn’t it be cool to invest in a car you love and can enjoy rather than a stock, and still have a healthy financial return? An investment in a collectible car is like buying a piece of history. If you’re looking for an alternative investment that is both fun and profitable, consider investing in a classic car.

Why not turn your hobby or love for classic cars into an investment? Ultimately, you may have an investment that not only looks good in your portfolio but on the highway. Just be sure to drive safely!

Coins:

Sure, you may have a few quarters jingling around in your pocket or purse right now. But what if I told you there were coins out there worth millions? No, I’m not talking about those newfangled Bitcoin things. I’m talking about actual, physical coins. The most expensive coin in the world is the 1794 Flowing Hair Silver Dollar, which was sold for $10 million USD in 2013.

Investing in coins is a great way to diversify your portfolio and hedge against inflation.

When it comes to investing in coins, there are many different options available. You can invest in gold, silver, or platinum coins. Or even rare and collectible coins. It’s best to invest in a variety of coins and only buy high-quality certified coins, within your target grade.

Pros of Investing in Coins:

- Coins protect against the risk of inflation

- A helpful way to diversify your portfolio

Cons of Investing in Coins:

- Not simple

- It often takes years to build value

- Not a quick profit. It’s a long-term investment.

- You’ll have to acquire knowledge before you acquire the coin. Do research to understand the investment

- Volatile market.

If you’re ready to dabble in coin investments and turn your coin collection into a lucrative venture, here’s what you should know: invest in what you love so you’ll still enjoy your collectibles even if you don’t earn a return. You can also implement a few strategies to minimize risk.

Art:

The secret’s out: there’s more to art than meets the eye. It can do more than spruce up a plain vanilla bedroom wall. Art is a great nontraditional investment and a wise one at that. It has quickly become the avocado toast of investment. There’s an art craze trend and it’s not just at Miami Beach’s Art Basel. It’s making its move to Wall Street and finance gurus’ investment portfolios.

According to a Deloitte report, contemporary art pieces have surpassed the S&P 500 by 131% from 1995-2021. Investing in art, just like stocks and bonds, can increase in value. But you won’t become a millionaire overnight. You’ll have to keep those paintings nailed to the wall for quite some time. Art is a long-term investment and experts recommend at least 10 years.

When you hear about people investing in art, you probably think of stuffy old men in top hats and monocles buying paintings for millions of dollars to stick on their walls and impress their dinner guests.

But art can be a great investment for regular people like us, too. You don’t have to be wealthy or have connections in the art world to get started. And you surely don’t have to buy expensive paintings, either. There are plenty of ways to get started investing in art without breaking the bank or the hassle of finding somewhere to store the artwork. Masterworks is a great option, especially for beginners.

What is Masterworks?

Masterworks is an online platform that makes it easy, accessible, and affordable for anyone to buy shares of high-end paintings, at a fraction of the cost. They do all the research and due diligence for you so that you can invest with confidence. Their industry-leading research team builds a diversified portfolio of expertly vetted works curated just for you. All you have to focus on is selecting the art that speaks to your heart.

And because you’re buying shares of a painting, rather than the whole thing, you can get started with as little as $20. Masterworks is the first platform that allows investors to buy and sell shares representing an investment in fine art. However, it’s currently only available to US citizens with US bank accounts.

If you’re looking for a more hands-on approach, you can always buy paintings yourself. Just make sure to do your research first. There are plenty of resources online (and offline) to help you learn about the art world and what to look for in a painting.

Whatever route you decide to go, remember that investing in art is a long-term game. Don’t expect to make a quick buck. Instead, focus on finding paintings you love that you think will increase in value over time. With a little patience and luck, you could end up with a real masterpiece.

Pros of Investing in Fine Art:

- Not highly correlated with the stock and bonds market, so no matter what happens with stocks, the art market is untouched.

- Can serve as a great hedge against inflation

- Can generate high returns, if you hold pieces for the longterm

Cons of Investing in Fine Art:

- Art is a risky business. It is nearly impossible to determine an artwork’s true value and there are a lot of dependent factors.

- You’re unlikely to get a huge payout from art alone

- You’ll also have to pay taxes to Uncle Sam on any gain since art is considered a collectible.

- It’s hard to quickly convert to cash. So if you’re in a bind, you can’t rely on art to bail you out.

- It’s associated with high costs unless you invest with Masterworks or a similar platform

When should you invest in art?

- If you love going to galleries and simply enjoy art.

- You’re not banking on profits, but would happily welcome any

- You’re prepared to do some research.

- You’ve got an established portfolio

Investing in art can be a great way to add some diversity to your portfolio and potentially make a profit down the road. For a new take on art and a willingness to take a little risk, why not give it a try?

Peer-to-peer Lending:

Now that we’ve whetted your appetite for alternative investments, let’s take a look at a viable option that often results in above-market returns all while helping people: Peer-to-Peer lending, or P2P, for short. It’s a great way to make a difference in someone’s life by helping them get on the path to financial health.

Peer-to-Peer Lending is a new way to borrow, lend, and invest money. In the past, if you wanted to loan money, you generally had to go through a financial institution like a bank. You had to patiently wait as they crunched numbers, only for them to stamp a big, red “REJECTION” across the paper application. Or if you were lucky and blessed with the elite 800 club membership, you happily walked out of the bank with a big smile and an approved application to go with it.

Now, with the advent of Peer-to-Peer Lending, it’s possible to connect investors with borrowers all over the world, who wouldn’t necessarily be approved for a traditional loan. This can all be done without ever having to leave your home.

The idea behind Peer-to-Peer Lending is simple: instead of going through a bank, you can loan money directly to someone else. You essentially become the bank or pretend you’re one. You provide capital to borrowers who are then able to use that money for things like starting a business or consolidating debt. In return, just like banks, you can earn interest on the loan, which can be paid monthly or quarterly. Peer-to-Peer Lending cuts out the middleman, which means you can earn a higher return on your investment.

It is a relatively new concept that has gained a lot of traction in recent years. It’s a great way to earn passive income and diversify your portfolio. And it’s a way to do something good with your money while helping someone else achieve their financial goals.

If you’re interested in Peer-to-Peer Lending, there are a few things you should know. Peer-to-Peer Lending is a relatively new industry, so there are some risks to consider. The biggest risk is that of defaults, which can happen if the borrower is unable to repay the loan. It’s important to do your homework and assess the borrower’s risk. You want to make sure you’re investing in someone who is likely to repay the loan.

The good news is that most Peer-to-Peer platforms have a built-in screening process to help you identify good borrowers. Additionally, to mitigate this risk, most Peer-to-Peer Lending platforms allow you to spread your investment across multiple loans, which diversifies your exposure and reduces the chance of losses. By diversifying across many different loans, if one borrower defaults, it’s not the end of the world.

With Peer-to-Peer Lending, you can often earn a higher return on your investment than what you would get from traditional savings accounts, stocks, or bonds. But it’s important to remember that it’s not without risks. As with any investment, you should only invest money that you’re comfortable losing.

Before you invest, here’s what you need to know:

Pros of Investing in Peer-to-Peer Lending

- The average ROI is between 7%-11%

- Competitive interest rates compared to traditional savings accounts

- You’ll keep more of what you earn. The investors pocket most of the interest since there is no middleman.

- P2P platforms help determine the risk of the borrower, so you can choose what level of risk you’re comfortable with

- You can make money while doing good

Cons of Investing in Peer-to-Peer Lending

- The borrower may default on the loan and it’s not FDIC-insured.

- Loans you make are not protected by the Financial Services Compensation Scheme, so if a borrower is unable to pay, you’ll suffer a financial loss.

- Early or late loan payoff may result in a lower ROI

- The platform can go out of business

- Profits are often taxable. However, you can receive income from P2P lending tax-free if you invest via Innovative Individual Savings Account (IFISA)

- Once the money is invested, you’re not able to liquidate it until the loan is repaid

- It lacks the liquidity of stocks and bonds

- Most loans are 3-5 years, so you’d have to wait some time before withdrawing any money

Ready to loan your funds to help someone have fun and obtain financial health? Here are some of the best Peer-to-Peer Lending platforms available. Be sure to compare rates and terms before choosing one.

- Prosper

- Payoff

- LendingClub

- Peerform

- Upstart

- StreetShares

- Funding Circle

- Kiva

Still a bit nervous if Peer-to-Peer Lending is a smart investment or if you’ll lose money? Prosper said, “Nobody who has made more than 100 loans on their platform has ever lost money.” The average return is 5%. However, you can see returns of 14%, if you decide to invest in loans to people with riskier credit. The higher the risk, the greater the return. Peer-to-Peer Lending is a different way to invest and is clearly not for everyone. But it’s definitely worth considering.

Venture Capital:

Another unique investment other than stocks that’s worth considering is Venture Capital. If you’re looking for high-risk, high-reward investment, then venturing into the world of venture capital might be for you.

Venture capital is when you invest in a company that is in its early stages. As an investor, you’ll have a say in where the money goes and how it’s used. Venture capitalists provide funding for things like research and development, product development, and marketing. Basically, you provide funding for startups in exchange for equity in the company. This can be a very risky investment, but it can also be highly profitable.

Investing in Venture Capital can be a great way to make a lot of money if the company succeeds. You could also see a higher return on your investment than with other types of investments. However, it can also be a great way to lose all of your money if the company fails.

Here are some things to keep in mind if you’re considering venturing into the world of venture capital:

Pros of Investing in Venture Capital

- The potential for a high return on your investment

- You have more control over where the money goes and how it’s used

- You’re investing in something that has the potential to grow and create jobs

- Front-row seats to the growth of a new startup

- Possible mentorship opportunities

Cons of Investing in Venture Capital

- There’s a higher risk of losing your investment

- You may not see a return on your investment for years or even decades

- You’re investing in something that is unproven and may not be successful

- Limited liquidity

If you’re thinking of investing in venture capital, it’s important to do your homework first:

- You’ll want to make sure that you’re investing in a reputable company with a sound business plan.

- Look for a firm that aligns with your values

- Do your research on the firms you’re considering investing in

- Talk to other people who have invested in venture capital and see what their experience was like

Investors searching for the next Amazon, Netflix or Uber might find it with venture capital. It can be a great way to invest in something you truly believe in and potentially make a lot of money. Historically, only accredited investors with annual income over $200k (or $300k if married) had an opportunity to immerse themselves in the world of venture capital. However, in 2015 the Jumpstart Our Business Startups Act was revised, which opened the door for ordinary investors to participate through crowdfunding.

Just be sure to do your research and understand the risks before you invest. It’s a risky business, so you should only dabble in venture capital with money you can afford to lose. As a general rule of thumb, it’s best not to invest more than 5% of your investment dollars.

If you’re ready to take the plunge into the highly profitable waters of venture capital, there are crowdfunding companies that offer investors the opportunity to invest in a broad range of startups:

- SharesPost

- MicroVentures

- AngelList

- SeedInvest

- FundersClub

- Crowdfunder

- Horizon Technology Finance

- StartEngine

Start An Online Business

You’ve probably thought about starting your own online business and have probably imagined how life would be if your idea magically evolved into an actual business. You could travel the world? Spend more time with your family and doing the things you truly love. Perhaps finally quit your 9-5 and escape to Bora Bora, where you’d just lounge in an overwater bungalow and enjoy life with no constraints? Or maybe you love your 9-5? Hey, not everyone wants to quit their 9-5 and travel the world. But either way, you’ve thought of countless ways of generating passive income or new investment ideas.

But that’s it, they’re all just thought bubbles stuck in your head. You ultimately resort back to what you know, until those ideas and thought bubbles reappear. But they’re drowned by the fear of the unknown, the fear of failing or leaving your comfort zone. You continue to tell yourself, “uhh next year.”

Why not THIS year? Why not right NOW? Right now is the best time for you to start your online business. Not just because it’ll give you passive income or potentially better quality of life but because it’s one of the best investments you’ll EVER make.

Why Starting an Online Business is One of the Best Investments

There are numerous reasons why starting an online business is one of the best investments you can make:

- Offers incredible scalability

- Provides limitless freedom

- Lower overhead and higher margins than a brick and mortar

- Fewer upfront costs

- Easy access to the global market

- Opportunity to generate passive income

- Total location freedom

- Opportunity for a high ROI

- Income security. You can control your income.

- You can do something fulfilling

- You’ll become more valuable, as you learn new skill sets and gain insights.

How to Start an Online Business

In 2022, it’s easier than ever to start an online business. All you need is a computer, domain name, internet connection, and a host. However, starting an online business takes a lot of time. But you don’t have to go full-on in. You can start part-time while working your regular job. You can launch your online business and work on it during the weekends or after work hours. Remember it’s not a sprint, but a marathon. When your business starts to gain traction, you can make the decision to pursue it full-time or to continue to use it as a passive income-generating investment.

If you have an entrepreneurial spirit, then you should consider starting your own online business. You can build your personal brand online by investing in a website. Think about what you want to be a thought leader or expert in, and then pursue it. Simply, find an idea that matches your skills and strengths. Or identify a market gap and start a business that fills it.

Best Online Business Ideas

You can sell products on Etsy or offer consulting services, create a blog or website, or even start an ecommerce store. The key is to find something that you’re passionate about and that has the potential to generate income. If you’re not sure where to start, don’t worry. For some of the best online business ideas, you can start here.

- Blogger

- Consultant

- Craft Seller

- Dropshipping

- Tutoring business

- Digital courses

- Resume and cover letter writer

Not only will investing in an online business give you the opportunity to make money in a way that suits you, but it can also be a lot of fun too.

If you’re ready to make the leap into entrepreneurship and turn your skills and dreams into an engine growth business, here are some things to keep in mind before you board the entrepreneur-SHIP:

- When you’re first starting out, it’s important to set realistic goals. Don’t expect to make a million dollars overnight.

- It takes time, patience, and hard work to build a successful online business. Be prepared to put in the hours, too. A successful online business doesn’t run itself – you’ll need to put in the time and effort to make it a success.

- It’s not a get-rich-quick scheme, so don’t expect to see results overnight.

- Be prepared to face some competition. There are already a lot of businesses out there, so you’ll need to make sure your business stands out from the crowd.

But don’t be afraid to just start. The Hyatt Hotel didn’t back out from building new hotels because there are a lot of other hotel chains. BurgerFi didn’t change its mind about getting into the restaurant industry because there are already so many options, and neither should you. You’re different and will bring a new perspective and that’s what people want. The world needs YOU. Not another BurgerFi or Hyatt, but you. Don’t let the fear of striking out keep you from playing the game.

Build an online business and you build your very own financial fortress. You may face challenges but we believe without a doubt starting your own online business pays the best dividends. But it all starts with that first step. Trust me, you won’t regret it.

Invest in yourself:

One of the best investments you can make is not in stocks and bonds or rental property but in yourself. Investing in yourself is the best way to guarantee success and secure your future.

When you make a conscious effort to invest in yourself, you are making a commitment to become the best version of yourself possible. Investing in yourself is not a one-time event. It is a continuous journey that will take you to new heights, help you achieve your dreams, and give you the wings to reach your full potential.

Whether it’s taking a course to learn a new skill, investing in your health with regular exercise or healthy eating habits, or simply taking the time to relax and recharge, when you invest in yourself, you are guaranteed a return on your investment.

When you feel good, you are more likely to be productive and successful in all areas of your life. Whether that is your financial well-being, health, career, or personal development, you’re setting yourself up for future success.

How Do You Invest in Yourself?

If you’re looking for ways to invest in yourself, here are a few ideas to get you started:

Invest in Your Education:

Consider continuing your education or taking some courses to improve your skill set. Not only will this make you more marketable and potentially lead to a higher salary, but it will also give you a sense of satisfaction and accomplishment. Whether you’re taking a course to improve your job prospects or simply to learn something new, investing in your education is always a good idea. Seek out opportunities to gain the experience you need, through volunteering or internships. Hone your skills and take the time to expand your network, by connecting with professionals that will help you reach your goals.

Invest in Your Career:

If you’re looking to further your career, consider investing in some professional development courses or attending industry events, it’ll bring meaning to your life. You can also invest in your career by networking and building relationships with influential people. Aim for a work-life balance so you’re not burnt out. You won’t be able to make any use of your investments if you’re tired and burnt out.

Schedule time away to destress and renew. Set working boundaries to maintain your personal time. Be sure to eat your meals, and avoid skipping breakfast or lunch so you can get more work done. Find a mentor and board of directors (group of mentors) to help elevate your career.

Learn to say no, if more responsibilities will cause you to be overwhelmed. Spend your energy wisely on the things that will help you achieve your career goals. Take the reins on your earning potential. Don’t be afraid to negotiate and increase your ‘stock price.’ Present your wins and show your value.

Invest in Your Personal Growth:

If you want to reach your full potential, it’s important to invest in your personal growth. This could mean anything from reading self-help books to attending personal development workshops or participating in personal growth programs.

Invest in Your Health

Your health is your most important asset, so it’s crucial to invest in your physical and mental well-being. If you don’t pay to take care of your health now, you’ll pay more for your health later.

You can invest in your health by nourishing your body. This can mean anything from exercising regularly and eating a healthy diet to taking care of your mental health. It’s also important to get good sleep. In the quest for success or financial freedom, we often risk our health and deprive ourselves of our sleep. Try to create an evening routine that helps you achieve good sleep habits.

Invest in Your Relationships

Investing in your relationships is one of the most important things you can do for yourself. Whether it’s spending time with family and friends or investing in a romantic relationship, strong relationships are essential for a happy and fulfilled life.

It was the poet, John Donne that said, “No man is an island.” ALWAYS make time for the people in your life. We’re not promised tomorrow or forever. Make room for romance and have fun with your friends. If you forget about them on your rise to success, they might not be there for you if you ever hit rock bottom or to celebrate your milestones.

Invest in Your Future

One of the best ways to invest in yourself is to save for your future. This could mean setting up a retirement fund, creating financial goals, saving for a rainy day, or investing in a rental property. By planning for your future, you’re ensuring that you’ll have the financial security you need to live a comfortable life.

If you’re wanting more ideas on how to invest in yourself, the best way to find out is to ask successful people how they did it. Many of them will be happy to share their secrets with you or even mentor you.

It’s not always easy to invest in yourself, but it’s worth it. Investing in yourself requires time, energy, and effort but the rewards are limitless. Trust me, I know from experience.

Life is too short to not be the best version of yourself that you can be. So make a daily commitment to invest in yourself today and you’ll soon realize it’s the best decision you’ll ever make. Not only will you gain the knowledge and skills needed to get ahead in your career, but you’ll discover a new sense of purpose. You’ll be happier and more successful than you ever thought possible.

No matter how you choose to invest in yourself, remember that when you do, you’ll have a guaranteed return on your investment. If you’re feeling stuck in a rut, don’t wait for someone else to rescue you. Invest in yourself and create your own success story. It’s the best investment you’ll ever make. Your future self depends on it. Don’t let yourself down.

Conclusion

There are many different investment opportunities available, besides stocks and bonds or mutual funds. Investing in luxury watches, fine art, or starting an online business are just a few ideas to get you started on thinking outside the box when it comes to investments. Please don’t limit yourself to just the stock market. No matter what you choose, be sure to invest in yourself first and foremost. By doing so, you’ll ensure that you’re always making a smart investment. And always remember to diversify!

In this quest for financial freedom, finding new ways to invest is your BFF, and if you try any of the options above you’ll be on your way to happier travels on this journey called LIFE! We can’t wait to hear all about your unique investments.

What other non-stock investments do you know about? Have you made any unconventional investments? Let us know in the comments below!

Now STOP reading & GO book that trip! Still not inspired? Check out our other stories. Or stop by our social media pages, it’s where the cool investment kids hang out. Make yourself comfortable on our site, we’ll be adding some more investment content soon.

Cheers to Happily Ever Travels,

Avi & Mark

FAQs

What is a better investment than stocks?

Real estate investments have a much greater impact on investors’ portfolios. While buying a property is easy, there is not necessarily any way of keeping it. The ownership of property requires more sweat capital than investing in stocks. Another stock market alternative is exchange-traded funds.

How can I build wealth without stocks?

Money Market Funds

Money market funds are a great alternative to stocks. They offer higher interest rates and provide protection from stock market volatility. However, they come with their own risks. Interest rate risk is the biggest concern for money market investors. If interest rates rise, the value of money market investments will fall. Still, they offer a safe and relatively stable way to grow your money. If you’re looking for a stock market alternative, money market funds are worth considering.

Real Estate Investment Trust

The real estate investment trust (REIT) is an excellent alternative to stocks. REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends. This makes them an attractive investment for those seeking regular income from their investments.

Investment objectives are another important consideration when choosing how to invest your money. If you’re looking to protect your purchasing power from inflation, then real estate and Treasury inflation-protected securities (TIPS) may be a good fit for you.

Ultimately, the best way to build wealth is to diversify your investments across a variety of asset classes. This will help you achieve your financial goals while minimizing your risk.

Mutual & Private Equity funds

Mutual funds, private equity funds, and protected securities are all great alternative investments to stocks. Each has its own set of risks and rewards.

Mutual funds are a type of investment that pools money from many different investors and invests it in a variety of assets, such as stocks, bonds, and short-term debt. Private equity funds are a type of investment that is typically only available to accredited investors and invests in things like real estate or venture capital.

If you’re looking to diversify your portfolio and build wealth without stocks, these are all great options to consider. I hope this gives you some ideas about how to build wealth without stocks. As always, please consult a financial advisor before making any investment decisions.

5 Ways To Increase Income From Diversified Sources of Capital.

- Start with your 9-5. Try to negotiate a raise. Increase your net worth with skills and show added value to your company.

- Investing in rental property. People always need a place to live, so positioning yourself to offer affordable homes can be smartly invested.

- Leverage your expertise to offer consulting services. Use your industry expertise to diversify your income. Possibly start freelancing.

- Sell digital products. You can sell a course, templates, stock photos from your travels, or worksheets. The options are limitless.

- Monetize your social media through brand partnerships, affiliate marketing, ad revenue, or paid content. Always be transparent and honest.

Author’s note: This is not professional financial advice. Always consult a financial advisor before making any major investment decisions. If you’re in need of financial 4-1-1, SmartAsset’s free tool makes it super easy to find a qualified financial advisor. It’ll match you with 3 financial advisors in your area that can help you achieve your financial goals. It’s like a match made in heaven.